Research consistently shows that people want their professional advisors to ask them about charitable giving. And sooner rather than later.

The 2013 “U.S. Trust Study of the Philanthropic Conversation,” conducted in partnership with The Philanthropic Initiative, showed that virtually all high-net-worth people think this discussion should happen within the first several meetings with an advisor. A third think the topic of charitable giving should be raised in the very first meeting. Yet fewer than half feel their advisors are good at discussing personal or charitable goals with them.

Wondering how to start a conversation about charitable giving with your clients? Or looking to refresh it?

As part of an ongoing series, we’re asking some of New Hampshire’s most well-respected professional advisors how they “pop the question” about charitable giving.

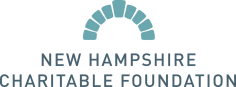

Jean Trim is a managing director and portfolio manager at Vigilant Capital Management in Portsmouth, and a member of the firm’s Investment Policy Committee; Bill Clifford is a managing director and wealth advisor at Vigilant. They work with clients together, as part of their firm’s team approach – most frequently around their clients’ kitchen tables. A wealth plan is created and the portfolio management strategy built to complement the goals of that plan. Other experts – in law, taxes and philanthropy – are brought to the table as needed to help craft a complete plan for clients to achieve their goals.

“We think they have to go together,” Trim said. “You can’t separate the planning from the management.”

The kitchen-table conversations certainly include spreadsheets. But they go way beyond that. The conversations are about building relationships.

“We want to know what is important to people,” Clifford said. They discuss goals, and philosophy. “Once they understand that the bills are covered and they have been able to do whatever they can for future generations, they’re trying to identify their own personal philosophy of what this wealth might mean to them.”

Those are pretty personal and intimate topics. In talking about priorities, and goals, and concerns, philanthropy often comes into the conversation. Conversations turn to “’What’s going on in the world, and how do we have a positive impact?’” Clifford said.

At one kitchen-table conversation, talk turned to concerns over New Hampshire’s opioid crisis, and a desire to be able to help kids in need. Clifford and Trim’s clients wanted to help, but were not quite sure of their own capacity to give. The Vigilant team’s wealth plan helped them to understand that capacity. “They had not given before in a significant way,” Trim said, “They had been wanting to do it for a long, long time and didn’t think they could…and Bill was able to say, from his analysis, ‘you can afford to help.’ And they were just so excited to figure out that they could have an impact.”

“They knew the general causes they wanted to help,” Trim said – but not how best to direct the funds to do the most good. Which, Trim and Clifford are the first to admit, they don’t know, either. “And so,” Clifford said, “you bring in the New Hampshire Charitable Foundation to help figure that out.” The team regularly calls on Foundation staff as philanthropy experts.

The couple decided to make donations to help fight the opioid epidemic and to help kids in need in New Hampshire. And, said Trim, they felt confident that they were directing their money wisely and “they were really excited” about their philanthropy.

Another client has established a scholarship fund in memory of a family member to help young people in New Hampshire go to college. Each year, the Vigilant team sits down with her as part of her budgeting process to determine how much to add to that scholarship fund.

Philanthropy becomes part of the regular conversation and budgeting process, as the team takes into account the full slate of variables, tax benefits and goals.

Clifford and Trim see philanthropy as one way for a generation to pass on values to the next.

“Clients say that all the time ‘you help me pass on the wealth, but how do I pass on the values?’” Trim said. Engaging multiple generations in conversations about philanthropy is one way to do that.

And, for some, philanthropy becomes the purpose of a new chapter of life. The Vigilant team has worked with business owners who, after selling a business that had been an all-consuming effort, wholeheartedly embrace philanthropic work. “Now they’ve got the resources of both time and money to go and make a difference,” Clifford said. Some do so by giving, some also serve on non-profit boards, advocate for causes they care about, even go to work for nonprofits. One such client recently sold a business has taken up the cause of increasing the minimum wage.

“He’s going to Washington, D.C. all the time…to advocate for increasing the minimum wage,” Clifford said, “It’s great. That’s the fun part. That would not have been on my to-do list: ‘Oh, let’s talk to so-and-so about raising the minimum wage…’ But your job, as an advisor, is to help figure out how to support whatever those goals are.”

For Clifford and Trim, the “philanthropy question” is not part of a set questionnaire or checklist. They have no single way of broaching the subject. “It’s case by case,” Clifford said. “We’re still learning.”

In their training – like that of many of their colleagues – they learned a great deal about the tax strategies and benefits for various philanthropic vehicles, but not much about how to have conversations about philanthropy more broadly with clients.

“You have to build a relationship where they are going to convey to you what is important to them,” Clifford said.

“Just don’t be afraid to have the conversation,” Trim said. Talking about charitable goals, she said, “just deepens the relationship. And they are so appreciative of it because other advisors did not talk about it – they just talked about ‘how we’re going to invest the money,’…Not, ‘let’s give it away,’ because our industry isn’t driven on that. But it’s helping people meet their objective of wanting to be philanthropic, so they are happier overall.”

The New Hampshire Charitable Foundation works with wealth managers and financial advisors, attorneys and accountants to craft customized, flexible giving strategies for their clients — helping generous people fulfill their philanthropic goals while maximizing tax benefits and reducing administrative burdens. For more information, please contact Melinda Mosier, vice president of donor engagement and philanthropy services, at zryvaqn.zbfvre@aups.bet or 603-225-6641 ext. 266.